MEDICARE ELIGIBILITY: Parts A, B, C & D

Part A Eligibility | Part B Eligibility | A/B Coverage Start Dates | Part C Eligibility | Part D Eligibility

Am I Eligible for Medicare?

To be eligible for Medicare, you must first be a U.S. Citizen or a permanent resident who has lived continuously in the United States for at least 5 years.

Most people become eligible for Medicare at age 65. You may also qualify for Medicare before you turn 65 if you have certain health conditions such as ALS (also known as amyotrophic lateral sclerosis, or Lou Gehrig’s disease).

You may also be eligible, and even automatically enrolled in Medicare Parts A & B, if you have received disability benefits from Social Security for 24 months or if you have received certain disability benefits from the Railroad Retirement Board for more than 24 months.

What if I am about to turn 65?

First off, Congratulations! Even though it may not feel like it, you are doing yourself a huge favor by taking the time to educate yourself. We are honored to help you!

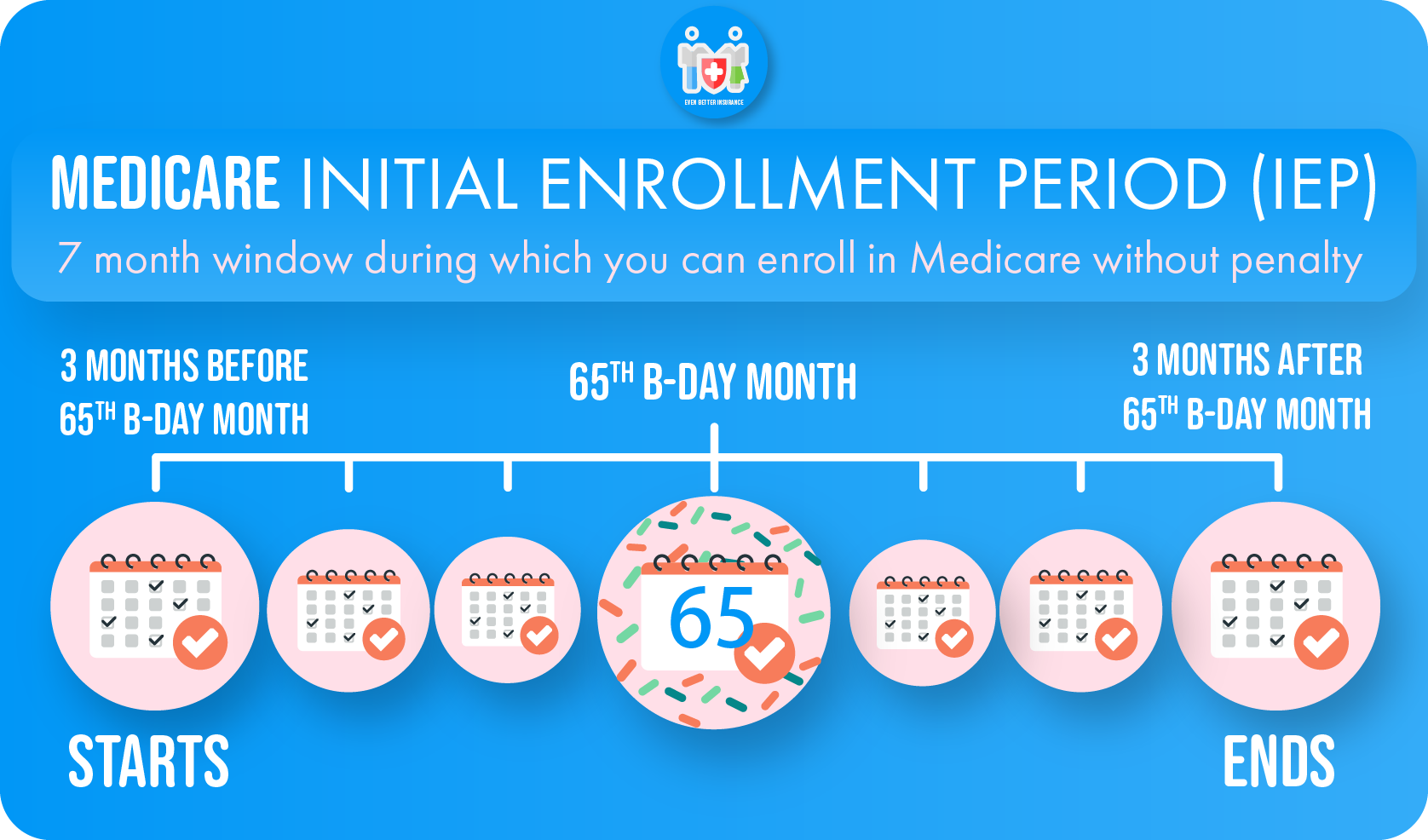

The most common question we get from folks planning for Medicare is “when should I apply?” The simple answer is as soon as possible! The government recommends applying for Medicare 3 months before your birthday month. So if you turn 65 in June, it’s recommended you apply in March. Here is a helpful chart to understand your initial enrollment period:

For a more detailed explanation of all the Medicare enrollment periods, click here.

On a tight deadline to apply, or missed your Initial Enrollment period? Do not worry! We understand life often gets in the way of the best laid plans - Our team of ‘Even Better’ Medicare Plan experts are standing by now to help you!

Part A Eligibility

Medicare Part A - Hospital Insurance is one of the two main pillars that make up Original Medicare. You are eligible for premium-free Part A if you or a spouse paid Medicare payroll taxes out of your paycheck for more than 10 years (or 40 quarters) in the United States.

If you are eligible to receive Medicare, but do not meet the requirements for premium-free Part A ($0 per month), you still have the option to buy Part A coverage. The average cost for Part A coverage $506 per month. Your cost may be reduced depending on how many quarters you have worked in some states.

If you are on Medicaid, and otherwise eligible for Medicare Parts A and B, but do not meet the work requirements to qualify for Premium-Free Part A, please see here.

Our ‘Even Better’ Medicare Plan experts are standing by to help you determine your Part A eligibility!

Part A Eligibility | Part B Eligibility | A/B Coverage Start Dates | Part C Eligibility | Part D Eligibility |

Part B Eligibility

Medicare Part B - Medical Insurance is the other main pillar of Original Medicare that you become eligible for when you turn 65. You have to pay a premium every month to the federal government in order to keep your Part B - Medical Insurance active. In 2023, the standard monthly premium for Part B is $164.90 per month. Keep in mind that the monthly premium changes every year.

You may be subject to a late-enrollment penalty if you do not sign up for Part B when you become eligible for Medicare, unless you are working and have creditable coverage through your employer’s group health insurance.

Your monthly Part B premium may also be more expensive if your adjusted gross income from your taxes two years ago are above a certain amount.

As with Part A (Hospital Insurance), your Part B premium may vary based on your income level and enrollment in your state’s Medicaid program.

Our ‘Even Better’ Medicare Plan experts are standing by to help you determine your Part B eligibility!

Part A Eligibility | Part B Eligibility | A/B Coverage Start Dates | Part C Eligibility | Part D Eligibility |

PART A & B COVERAGE START DATES

Part C Eligibility

Medicare Part C (known as Medicare Advantage) is a category of Medicare health insurance plan offered by private health insurance companies approved by Medicare.

To be eligible to select a Part C plan you must have and keep both Part A (Hospital insurance) and Part B (Medical Insurance) active, and live in the plan’s service area (the ‘service area’ is typically a geographic area like a county).

Although many Part C plans have low to no monthly premiums, it is extremely important to remember that you must continue to keep paying your monthly Part B premium to the federal government!

Our ‘Even Better’ Medicare plan experts are standing by to help you determine your Part C eligibility!

Part A Eligibility | Part B Eligibility | A/B Coverage Start Dates | Part C Eligibility | Part D Eligibility |

Part D Eligibility

Medicare Part D - Prescription drug coverage plans help cover the cost of prescription drugs (including many recommended shots and vaccines). Part D plans are run by private insurance companies that follow rules set by Medicare.

To be eligible to enroll in stand alone Part D coverage, you must be enrolled in either Part A or Part B (or both) and live in the plan’s service area.

TIP Many Part C - Medicare Advantage plans include some type of Part D coverage. If you decide to get your Part D coverage as part of a Medicare Advantage Plan, you must stay enrolled in Part A and Part B by paying the necessary monthly premiums.

To avoid late enrollment penalties, you must enroll in some type of Part D coverage when you first become eligible for Medicare, unless you have creditable coverage through your employer’s sponsored health insurance.

Our ‘Even Better’ Medicare Plan experts are standing by to help you determine your Part D eligibility!

Part A Eligibility | Part B Eligibility | A/B Coverage Start Dates | Part C Eligibility | Part D Eligibility |

Common Eligibility Questions

I think I am eligible. When can I enroll? For a more detailed explanation of all the Medicare enrollment periods, click here.

Am I Required to sign up for Medicare when I turn 65? No, however, unless you have a special circumstance or have employer sponsored health coverage (also known as creditable coverage) you will incur a late enrollment penalty that sticks with you for life.

Does my enrollment in Medicaid affect my eligibility for Medicare? If you have Medicaid, you should sign up for Part B. Medicare will pay first, and Medicaid will pay second. In many states, Medicaid may be able to help pay your Medicare out-of-pocket costs (like premiums, deductibles, coinsurances, and copayments) depending on the type of Medicaid you are enrolled in.

Am I eligible for Medicare as soon I start withdrawing my Social Security? No, unless you have a disability or other special circumstance, you are eligible for Medicare when you turn 65.

What about if I have a pre-existing condition? There are no waiting periods to enroll in Part A, B, C, or D. However, Medicare Supplement (also known as Medigap) plans may have a coverage waiting period based on pre-existing conditions if you apply for the plan outside of your guaranteed issue periods.

We’re here for you and always happy to help. Our ‘Even Better’ Medicare plan experts are standing by now to help answer any and all of your eligibility questions!

Part A Eligibility | Part B Eligibility | A/B Coverage Start Dates | Part C Eligibility | Part D Eligibility