What is a Medicare Supplement (Medigap)?

10 essential things about Medigap | How do Medigap plans work? | What Medigap plans are available?

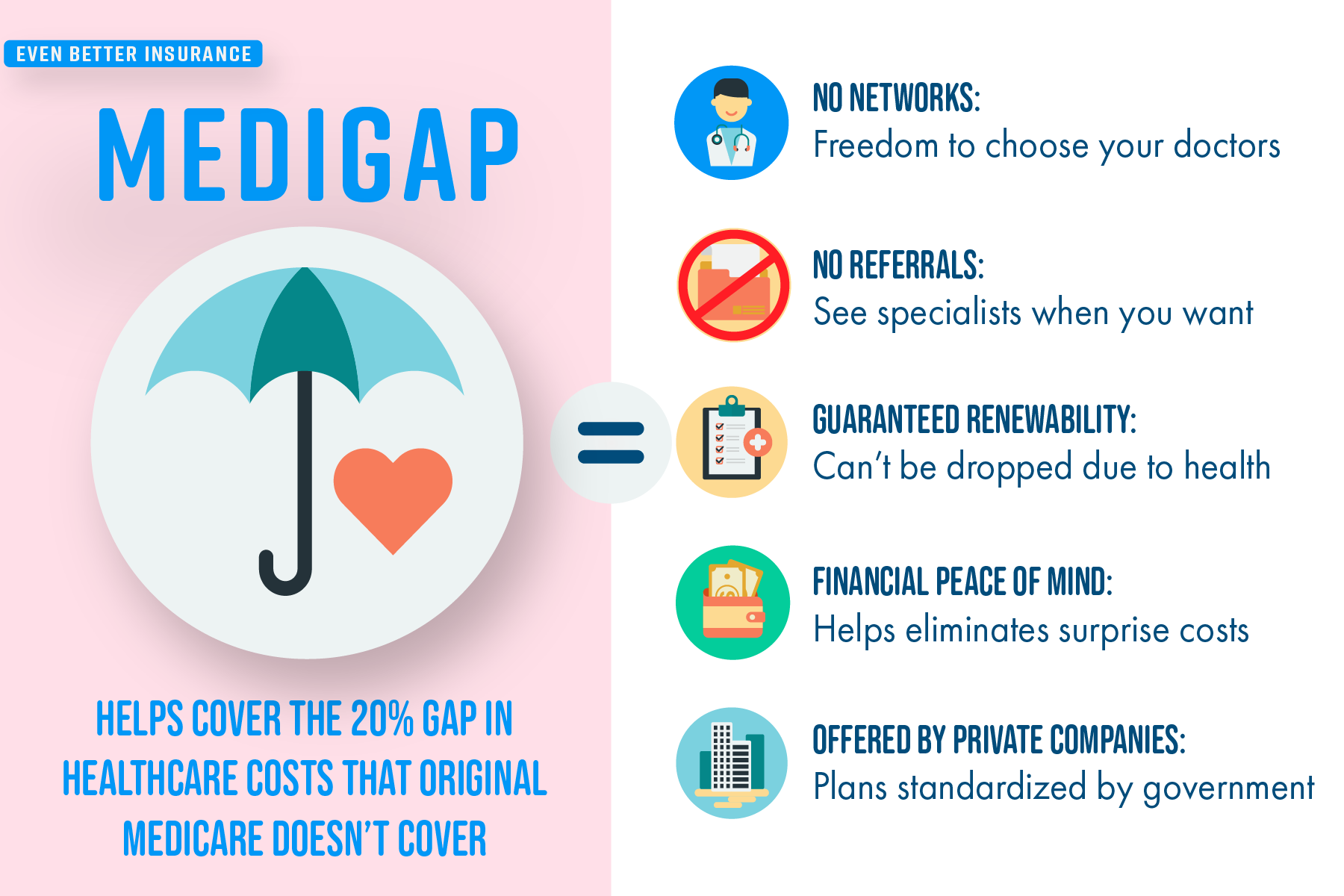

Original Medicare (Part A and Part B together) only covers 80% of your healthcare costs, leaving you with a 20% gap in coverage that can be financially devastating if you become seriously ill.

A Medicare Supplement (also known as ‘Medigap’) is an insurance product offered by private insurance companies meant to cover some or all of that 20% ‘gap’ in your healthcare costs - namely the Part A and Part B deductibles, copayments and coinsurance for services and supplies that you are normally responsible for paying out of your own pocket.

Medicare Supplements are often called Medigap plans. They are simply two names for the same product. You will see both terms ‘Medicare Supplement’ and ‘Medigap’ interchangeably throughout our website.

Some Medigap plans even offer additional coverage beyond what Medicare offers for things like international travel emergency coverage and fitness memberships. Medigap policies do not, however, offer coverage for long term care or private duty nursing.

10 essential things to know about Medicare Supplements (also known as Medigap):

You must be enrolled in Original Medicare (have Parts A and B together) in order to qualify.

Medicare Supplements (Medigap) is not the same thing as Medicare Advantage (Part C). Medicare Advantage is geared towards getting additional health and wellness benefits in an affordable manner. Medigap plans only ‘supplement’ the gaps in your Original Medicare and do NOT include prescription drug coverage.

Medicare Supplement monthly premiums can be expensive and can increase every year.

You still have to pay your Part B premium in addition to the Medigap monthly premium.

Medigap plans only cover individuals. You and your spouse must buy separate policies.

You can buy a Medigap plan from any health insurance company licensed in your state.

Once you are enrolled in a standard Medigap plan, the health insurance company cannot cancel or drop you as long as you continue paying premiums.

You’ll still need to get a Part D plan (prescription drug coverage) even if you don’t take prescription drugs in order to eliminate any Part D late enrollment penalties.

You CANNOT have a Medigap plan and a Medicare Advantage plan at the same time. You can only be enrolled in one or the other at a time.

Do not confuse Medicare Parts A, B, C and D with Medigap Plans A, B, C, or D.

10 essential things about Medigap | How do Medigap plans work? | What Medigap plans are available?

How do Medigap plans work?

No Networks

Medigap plans can be a great option because they allow you to see any doctor anywhere in the USA that accepts Medicare. It does not matter which insurance company you purchase your Medigap plan through - as long as that doctor takes Medicare, you can see them and be covered by your Medigap plan!

Monthly Premiums

Though the basic benefits for each Medigap plan are standardized, the premiums that you’ll pay when comparing companies is not. Each health insurance company sets their own premium rates for their Medigap plans. There are several methods that they can use to determine their rates:

Attained-age-rated: The premium is based on your current age at the time you buy the supplement and your premium will increase as you get older (typically on your birthday). Premiums may be very low at a younger age but may be extremely high at an advanced age, going from least expensive to extremely expensive. Premiums may also go up because of inflation and other factors as well.

Community-rated (aka no age-rated): The same monthly premium will be charged to everyone who buys this Medigap plan regardless of what age they are. Premiums may increase based on factors like inflation though so it’s important to pay attention to any rate changes.

Issue-age-rated (aka entry age-rated): The premium is based on your age at the time you purchase the Medigap plan. The younger you are the lower your premiums will be. Your premiums will NOT increase with age, but may increase based on factors like inflation and more.

Eligibility

Medicare Supplement plans are meant to work with your Original Medicare, so to be eligible for a Medicare Supplement, you must be enrolled in Original Medicare.

If you are under 65 and have Original Medicare, you may also be able to purchase a Medicare Supplement depending on the state you live in.

Whether or not you qualify for guaranteed issue (the ability to enroll in a Medigap policy without being asked health questions or be denied due to your health) depends on the time period you enroll and can also depend on the state you reside in.

Pre-existing health conditions may also affect your rate that you’ll pay and if you are subject to any coverage waiting periods.

See our article Medigap Eligibility for a more in-depth look at eligibility requirements and when you can apply for Medigap plans (insert Medigap Eligibility link).

10 essential things about Medigap | How do Medigap plans work? | What Medigap plans are available?

What Medigap plans are available?

There are 10 standard Medigap plans, all of which are identified by letters. The 10 plans are: Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, Plan M, and Plan N.

The federal government came up with the alphabetical plan identifiers as a way to standardize the Medigap plan offerings so that no matter which company you buy through, the plan you choose will have the same basic benefits.

So the only differences between buying Plan G through Company 1234 or Company XYZ are the monthly premium amount that you’ll pay and the additional benefits or coverage that one company may add on top of the standardized Plan G benefits over another company.

If you live in Massachusetts, Minnesota or Wisconsin, Medigap plans in those states are classified differently from the rest of the United States.

For a helpful chart and more information on which Medigap plan may be right for you, check out our guide to Medicare Supplement plans.

10 essential things about Medigap | How do Medigap plans work? | What Medigap plans are available?

Need more help understanding Medicare Supplements or finding out which plans are available in your area? Our ‘Even Better’ Medicare plan experts are standing by to help!

10 essential things about Medigap | How do Medigap plans work? | What Medigap plans are available?