What is Medicare Advantage?

How do these plans work? | How are these plans structured? | Costs | Networks | Common questions

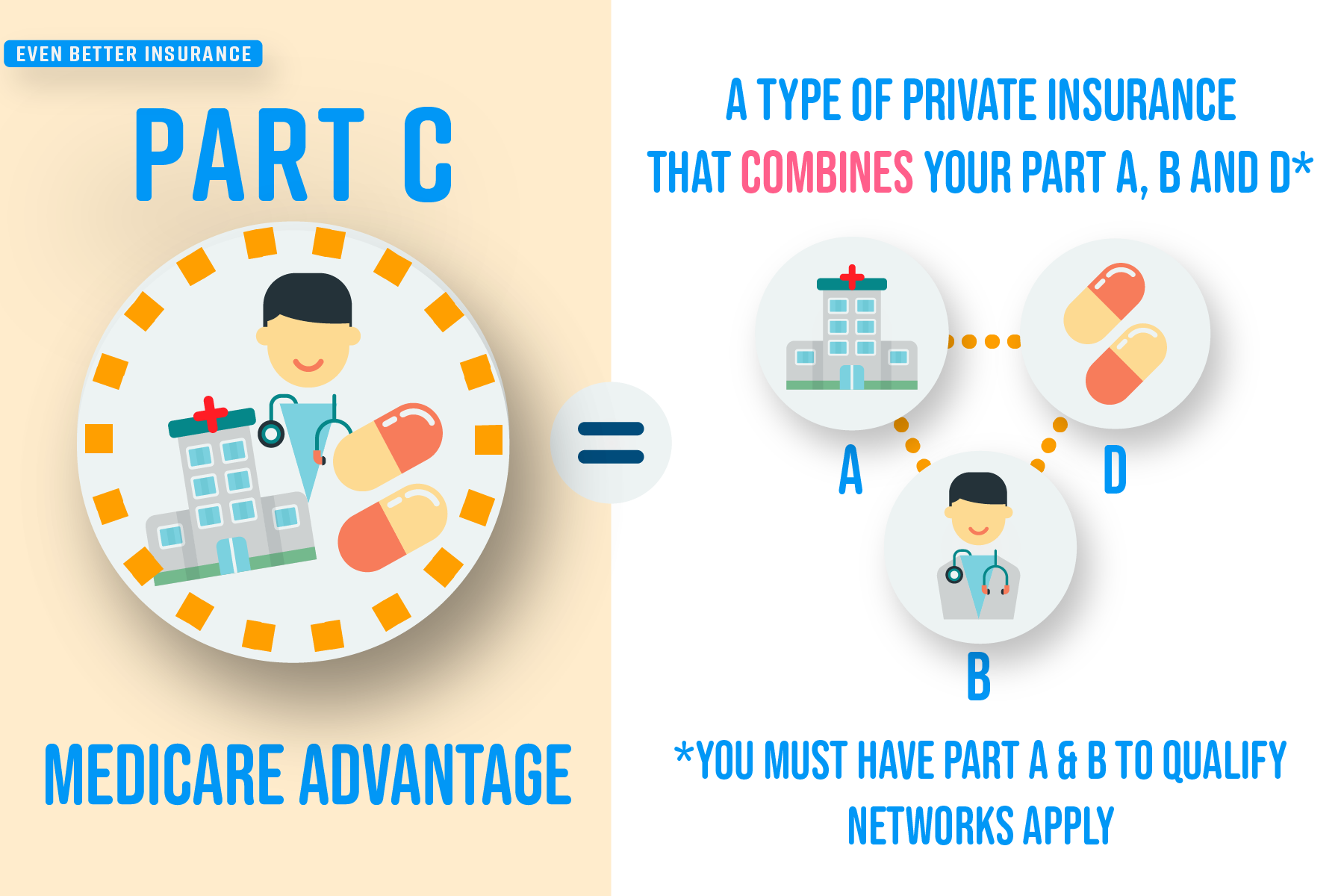

Medicare Advantage (another name for Medicare Part C) is a category of health insurance plans that are operated by private health insurance companies who are contracted with the federal government and follow rules set by Medicare.

These plans are designed to cover the 20% gap in your healthcare costs that Original Medicare (your Parts A & B together) does not cover and are required by law to cover all of the services covered under Original Medicare.

Medicare Advantage plans often include prescription drug coverage at no additional premium and can be a great way to satisfy Medicare requirements for Part D coverage in order for you to avoid Part D late enrollment penalties.

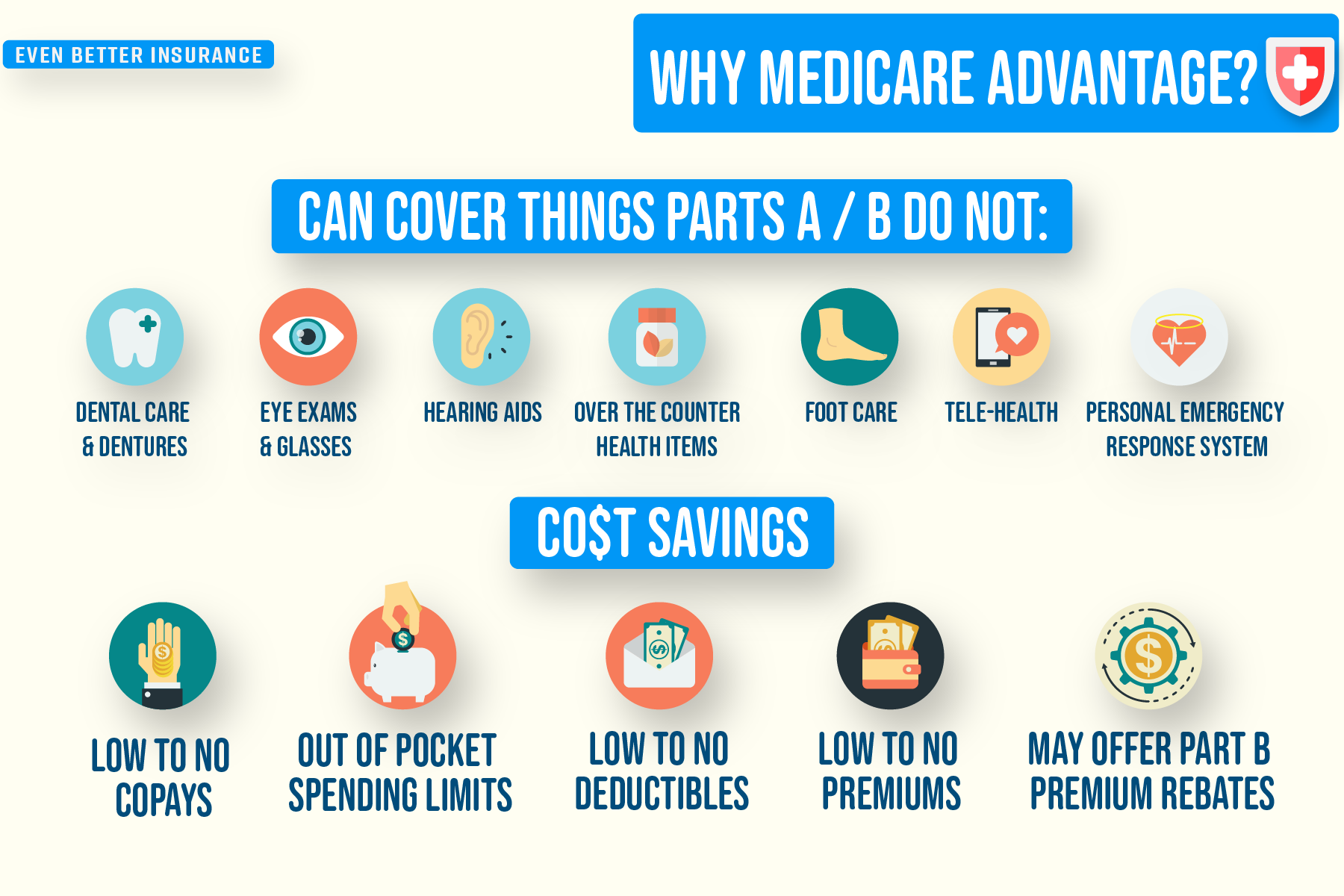

Many plans also include additional coverage and benefits that Original Medicare does not offer: vision, dental, hearing, over-the-counter item allowances, no cost gym memberships, private transportation to your doctor visits, tele-health, acupuncture and more.

There are even Medicare Advantage plans tailored to people with chronic conditions like diabetes, cardiovascular disorders and more. These plans may cover drugs needed to treat your chronic condition at a much cheaper price or may even offer additional wellness benefits proven to help with your specific chronic condition.

How do these plans work?

Medicare Advantage plans act as an alternative way to get your Medicare coverage. While you are on the plan, the health plan administers your Medicare benefits and is compensated by Medicare for doing so. The plan does not permanently replace your Medicare when you join, it simply takes over as the administrator of your Medicare benefits as long as you are enrolled in the plan. This is an important distinction to understand and is often why these Medicare Advantage plans can be commonly referred to ‘replacement plans’ even though that term is technically incorrect.

When you receive treatment, you simply present your Medicare Advantage plan ID card to the provider and their office will bill the Medicare Advantage health plan instead of Medicare.

How do these plans work? | How are these plans structured? | Costs | Networks | Common questions

How are these plans structured?

Medicare Advantage plans can be a great option to help you save money and get extra benefits Original Medicare doesn’t cover, but understanding how these plans are structured is key to getting the cost savings and benefits while minimizing stress.

Costs

Many Medicare Advantage plans costs are structured the same way. So when considering joining a Medicare Advantage plan, we always advise examining a few key details first (these can be found in a common type of Medicare Advantage plan document called the “Summary of Benefits”):

Premiums - How much you’ll be paying a month just to stay enrolled in the plan.

Deductibles - An amount you’ll have to pay out of your pocket before the plan coverage will pay their portion for a service. Some plans lower or eliminate deductibles for things like inpatient hospitalization that you would otherwise have to pay if you only had Original Medicare (Parts A & B).

Copayments - A predetermined flat fee you’ll pay when seeking care. A majority of your costs on a Medicare Advantage plan will be in the form of copayments. Co-payments can be for things like primary care and specialist doctor visits, lab and blood work, MRI’s etc… Each Medicare Plan’s copayments are different and depend on the service area you live in and other factors.

Coinsurance - A predetermined amount (in the form of a percentage) you’ll pay alongside the health plan for a covered service. Coinsurances can be charged for purchasing durable medical equipment (DME) like canes, walkers etc; meaning that you are responsible for paying a percentage of the total cost for that equipment rather than a fixed dollar amount.

Out of Pocket Maximum - The most you have to pay for covered services in a plan year. After you spend this dollar amount on deductibles, copayments, and coinsurance for in-network care and services, your health plan pays 100% of the costs of covered benefits. This is one of the biggest advantages of Medicare Advantage compared to only using your Original Medicare. Medicare Advantage plans set a limit to what you’ll spend out of your own pocket on healthcare every plan year. For example: If you are incredibly ill one year and hospitalized frequently or have a catastrophic accident, Original Medicare has no limit to protect what you’ll spend on your healthcare bills, so in theory you could easily be stuck with $100,000 in medical bills for that year. With Medicare Advantage however, in that same scenario, you only pay up to your plan’s maximum out of pocket.

**YOU MUST STILL PAY YOUR PART B PREMIUM** - In order to maintain eligibility for Medicare Advantage you must ensure your Part A and Part B is current by paying the premium every month. Many people incorrectly assume that because Medicare Advantage plans essentially bundle their Part A, Part B and Part D coverage, they do not need to keep paying their Part B Premium to the government every month.

How do these plans work? | How are these plans structured? | Costs | Networks | Common questions

Networks

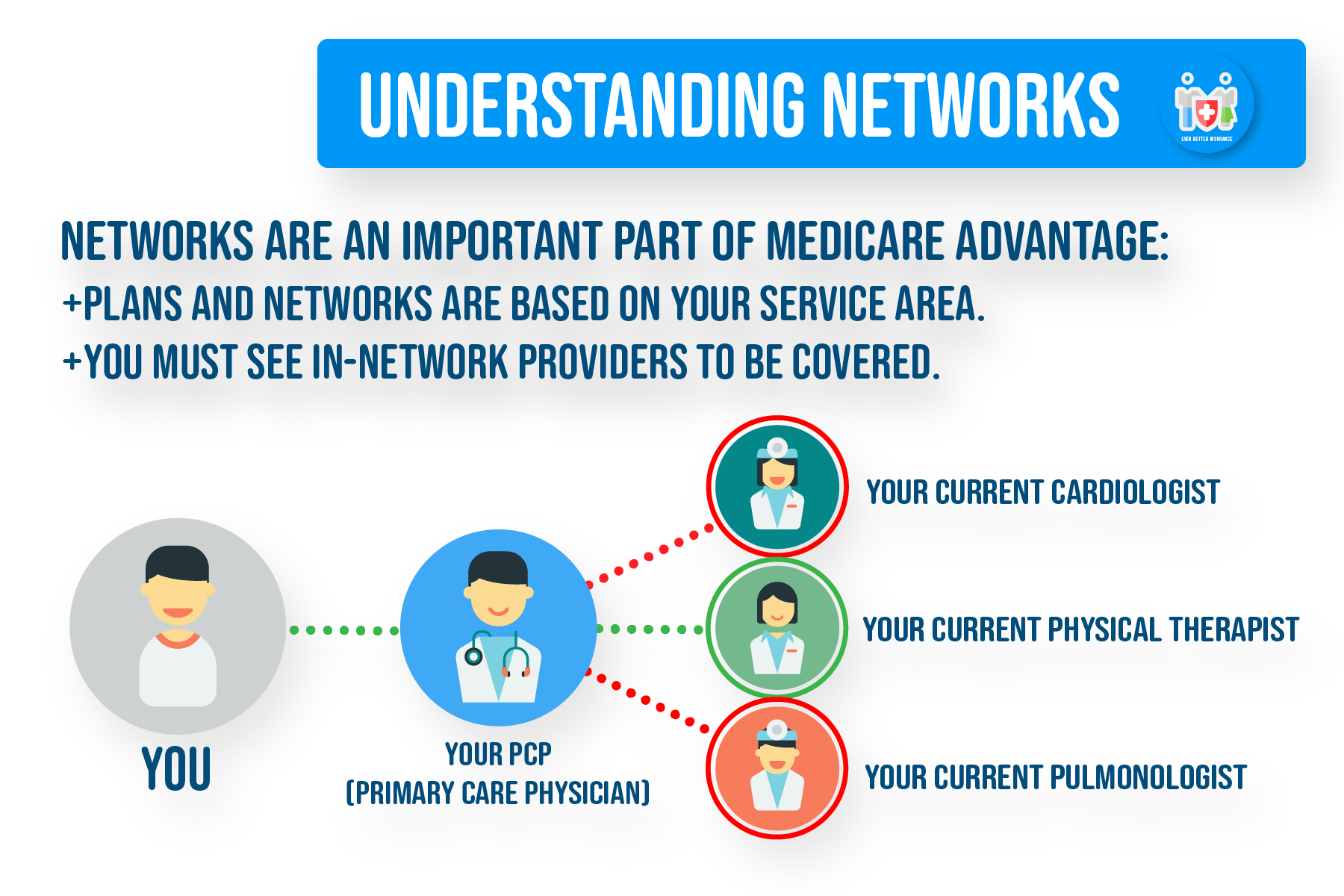

The other key component of Medicare Advantage is the use of networks. A network is the pool of doctors or companies that you can see/use in order to get the advertised in-network rate. Your network is often determined by the service area you live in.

In-Network - These are the providers you can choose from. These doctors and vendors have contracted with the health plan to provide you services and benefits at the rate the plan advertised.

Out-of-Network - These are the providers that do not accept the health plan. If you do get services from an Out-of-Network provider, you will pay a much higher rate for a service or benefit.

**Emergency Room care, Urgent care and Out-of Network Dialysis are considered an in-network service even if you are outside your service area, for example if you are traveling in another county or state.**

Referrals/ Approvals: While Medicare Advantage plans must cover everything Original Medicare covers, you may come across a service or a supply that isn’t considered medically necessary. On many Medicare Advantage plans, the non medically necessary services you seek must be ‘approved’ by the health plan in order to get the plan’s advertised copayment rate or cost-sharing rate, otherwise you may pay a higher rate or be responsible for the entire amount.

If you are denied approval for a service, you will have the option to appeal the determination.

To learn more about all the different types of Medicare Advantage plans available, see our Types of Medicare Advantage.

How do these plans work? | How are these plans structured? | Costs | Networks | Common questions

Common Questions

Is Medicare Advantage right for me? Medicare Advantage plans can often be a great option for people seeking to lower their overall healthcare costs, because these plans can offer competitive premiums, deductibles, copayments and coinsurance amounts. The fact that many plans include extra benefits and Part D prescription drug coverage at no additional premium is attractive too. Nothing is perfect though. That’s why it is important to understand the rules and guidelines for getting your care through a Medicare Advantage plan.

The fact that you will have to seek care from contracted providers and vendors within the network can sometimes limit your choice. When considering Medicare Advantage, we always recommend letting our ‘Even Better’ Medicare plan experts help compare your options and talk with you to determine if Medicare Advantage is a good fit for you! (contact us)

Medicare Advantage is the same thing as a Medicare Supplement right? NO. Medicare Advantage is not a Medicare Supplement, nor vice versa. This is a common question we get from clients and is always a common source of confusion.

The only similarity between Medicare Advantage (Part C) plans and Medicare Supplements (Medigap) is that, by definition, they are extra coverages designed to help you cover the 20% costs you are traditionally responsible for when you have your Medicare Parts A and B. That is where the similarities end. They are set up and operate in completely different ways with different criteria for eligibility, coverages and costs.

For a more detailed breakdown of Medicare Advantage vs Medigap, read this (link to Med Ad vs Medigap)

I have both Medicare and Medicaid, do I qualify for Medicare Advantage? You may qualify for a specific type of Medicare Advantage plan known as a Dual Special Needs Plan (D-SNP), depending on your level of Medicaid. These D-SNP plans are a type of Medicare Advantage plan where your Medicaid may pay for certain costs that others without Medicaid would normally be responsible for, therefore reducing your healthcare costs while giving you access to the benefits that the plan may offer. Keep in mind though, that with all Medicare Advantage plans, you will likely be subject to network restrictions, approvals, referrals etc. For more info, see our article Types of Medicare Advantage Plans (insert link Types of MEd adv).

What if I have other insurance coverage? Remember, Medicare is an individual benefit. That’s why we always recommend talking with your employer, union or other benefits administrator before considering joining a Medicare Advantage plan. In some cases joining a plan causes you to lose that current coverage for you, your spouse, or your dependents. Many employer, retiree or union plans will not allow to jump back on if you leave to join a Medicare Advantage plan.

In other cases, though, you may still be able to use your employer or union coverage along with the Medicare Advantage Plan you join. Your employer or union may also offer a Medicare Advantage retiree health plan that they sponsor. It’s always recommended to check with your benefits administrator.

How do these plans work? | How are these plans structured? | Costs | Networks | Common questions